Changing Timeframe of OHLC Candlestick Data in Pandas

I had mentioned in a previous post, that I'm working on a Python module for downloading historical stock data for free using my broker's web APIs. The module is finished now, and right now I'm working on setting up a module for algorithmic trading using the same data.

The idea is to run a strategy that can do some analysis on the historical data and emit a signal like BUY, SELL, or HOLD.

Now, the strategy might be a little complex that it needs multiple timeframe data to confirm the strength of the signal. For example, it might want to check for signal every 5 minutes, but also wants to look at what's happening at a larger timeframe like 1 hour to discard any short term signals that are actually noises.

How to Resample OHLC Data in Pandas #

Let's load a smaller timeframe data.

I'll load 1 minute intraday OHLC data as that can be resampled to any other timeframe I want. Stock is HDFC Bank trading in NSE.

import pandas as pd

data = pd.read_csv('HDFCBANK_1min.csv', index_col=0, parse_dates=True)

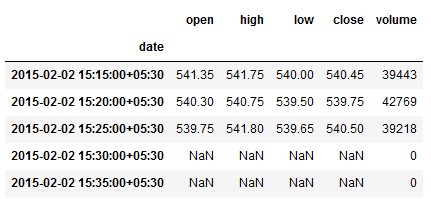

data.head()As my data is already stored nicely in CSV format, the dataframe looks like below.

Now, I want to resample it to 5 minute data, which should have opening price same as first 1 minute candle, high price as maximum of five candles, low price as minimum of five candles, close as close of fifth candle, and volume data as sum of the five candles.

Naive approach would have been to loop over the DataFrame and calculate these, But luckily for us, Pandas already has an API to do this: resample.

Here's how to use this in this instance...

Note: base=15 is not really needed for 5 minute sampling, but it'll be required if you want to maintain 9:15 AM as the starting point even when you are sampling for 30 minute or 1 hour data. Without this, the sampled data will start from 9:00 AM.

ohlc = {

'open': 'first',

'high': 'max',

'low': 'min',

'close': 'last',

'volume': 'sum'

}

df = data.resample('5min', base=15).apply(ohlc)

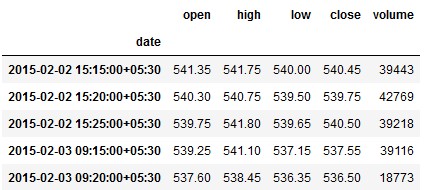

df.head()Voila! You get 5 minute data nicely formatted!

1.0.3. If you are any other version of Pandas, feel free to consult the documentation. Here is how you can check Pandas version: pd.__version__, or for any Python module.Can We Ever Have a Life without Caveat #

I guess not!

Pandas resample API although works beautifully, it also samples data that did not exist, e.g. non-trading hours data. Indian markets open at 9:15 AM and closes at 3:30 PM #. However, if you try to peek at the data between two trading days, you'll see Pandas has introduces NaN data for non-trading hours like below.

A quick fix would be to use another Pandas API, between_time as follows

df = df.between_time('09:15', '15:25')And you get correct result

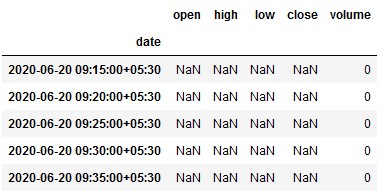

However, non-trading days (Saturday, Sunday, and any other trading holidays) will still have incorrect data. For example, 20th June 2020 should not have any data, but it has been now filled with NaN from 9:15 AM to 3:30 PM.

How to Fix Non-trading Day Resampling #

Frankly, I have not yet found a proper way to fix this.

Ideally, you can have a list of non-trading days, and you can filter out the data using that list. But it comes with extra headache of collecting non-trading days for historical data. Also, some days, trading might happen at a different time than usual, for example, Indian markets open on the evening of Diwali, for Muhurat Trading, sometime between 6PM and 7PM.

So the problem is two-fold now.

What I have done for now is simply filtered out any row having NaN data as opening price instead of using between_time.

df = df.drop(df[df.open.isnull()].index) # Better to check all of them?

df.loc['2020-06-19 15:20:00':'2020-06-22 09:20:00'].head()Now, data between Friday and Monday is filtered properly.

But this will work properly, if your data is otherwise clean. Or may be check if every piece of data for an index in NaN and filter based on that. Don't check if volume is zero though, that can actually happen for some stocks on a relatively less active trading day, or if the stock is hitting circuits for some time, or the stock does not have enough liquidity.